SEO campaigns have multiple options of keyword focus. Whether you provide insurance policies or greetings cards, you need to make important campaign choices. For example, should you focus more on commercial owners insurance keywords or professional indemnity keywords? Birthday cards for Mum or birthday cards for Dad? Which of these keyword clusters should you prioritise in your campaign and which should you put on the backburner or even ignore entirely? Getting the answer right could see you attaining the summit of ROI. Getting it wrong could send you on an expedition up a mountain that isn’t worth climbing.

In this post, we explore why it can seem difficult to know which mountain to climb, and outline a spreadsheet-based method to help you find your campaign’s Kilimanjaros – the mountains of keyword intent which represent the best ROI for your campaign.

Why SEO Campaign prioritisation comes first

When the aim of the campaign is to maximise performance within a given budget, each option of focus naturally needs to be ranked by net potential gain to determine which ones matter more in relation to the aim and which ones matter less or not at all.

Areas which won’t yield a net KPI gain in response to the application of campaign budget are irrelevant to the ultimate campaign aim thus defined and should be removed from consideration in relation to that aim, freeing up more focus to put to better use in approaching it.

But it’s not immediately obvious where the biggest net gains in response to SEO campaign activity will come from, because the rules of the system in which pages compete for prominence in organic search are manifold & complex.

SEO campaign targeting is the process by which the hierarchy of the areas of greatest net gain can be made evident despite this complexity.

The product of this pruning process is a list of ranked survivors, the areas most relevant to the achievement of the aim – those that will yield the biggest KPI improvements per unit of budget. The assignment of campaign budget & strategic focus in accordance with this prioritisation is the foundation of a maximally successful SEO campaign.

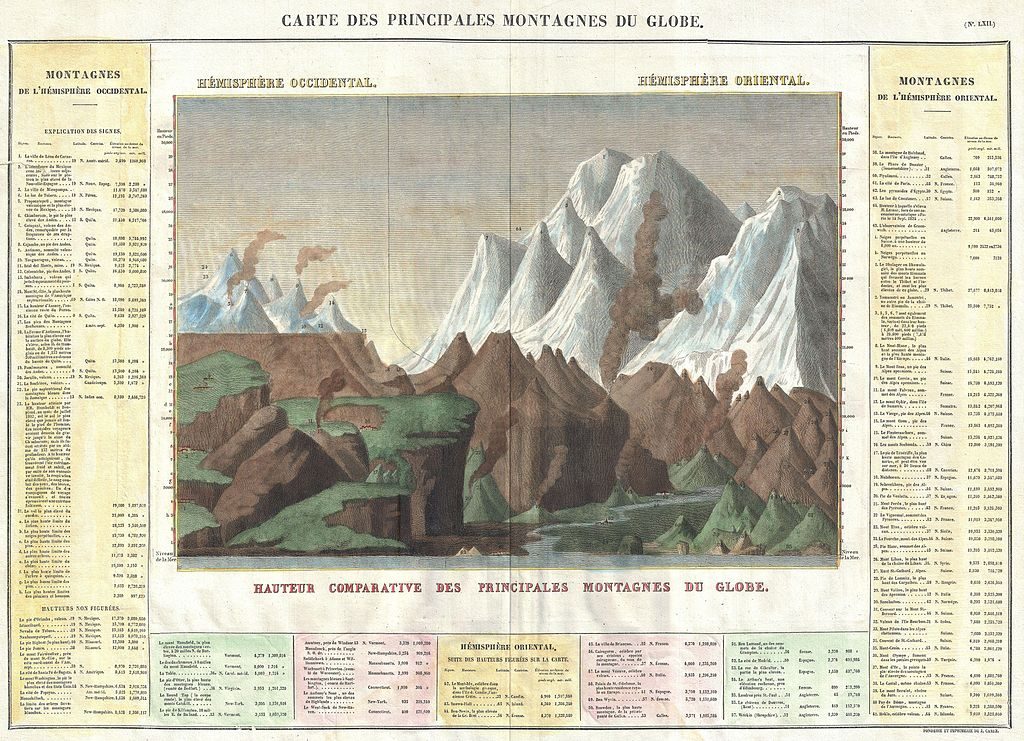

Search is Mountainous

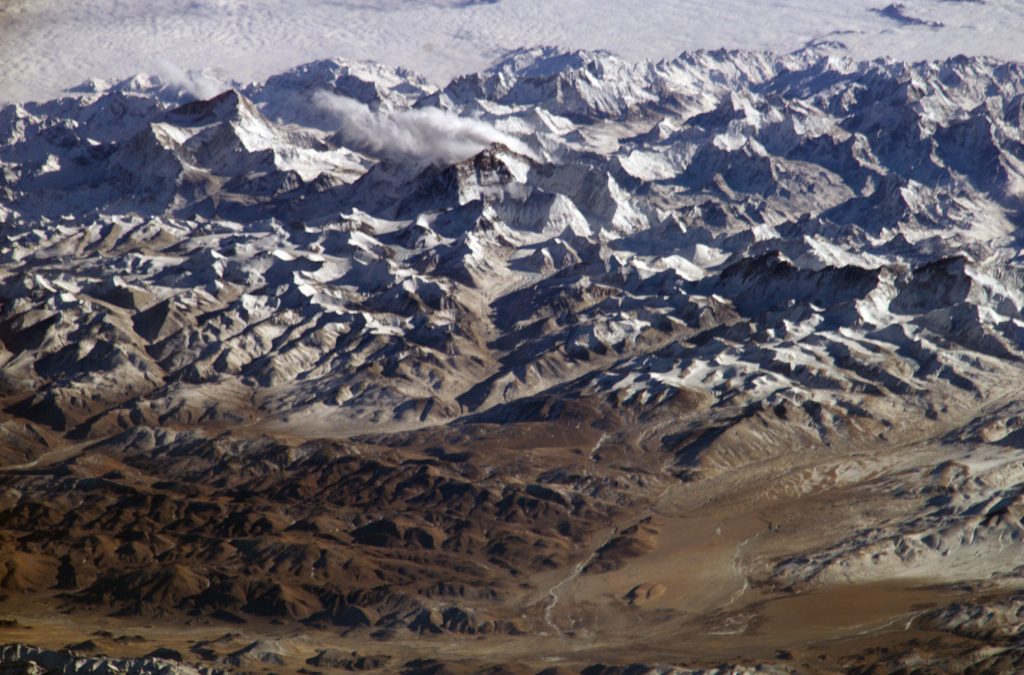

The campaign targeting process begins with the act of seeing the search landscape. It can’t be seen directly because it’s made up of abstractions, but its features can be discerned indirectly through the use of tools. Like a real landscape, it has mountains, only they’re made of intent-clustered amalgams of keyword SERPs rather than gneiss & granite. The higher the mountain, the greater the commercial reward of nearing its summit. Some are little more than hills. Others are majestic peaks.

A representational model is constructed to record what matters about the landscape in relation to the campaign aim – the search landscape document. Like a map of a mountain range, it’s a representation of the features of landscape which may be relevant and it’s something which can be returned to conveniently throughout the campaign.

If you have an established site, you are already sending expeditions of varying levels of proficiency up many of these mountains. Some of your expeditions (pages) have shown natural flair and are already part way up the mountain or even near the summit.

But some of your expedition teams have stalled, and you naturally want to know why.

A. Overstretched supply lines – a link equity problem.

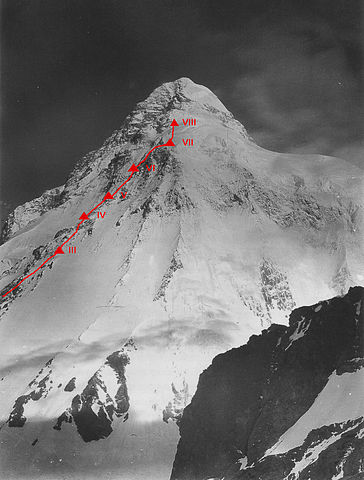

At 8.6 km high, K2 is the world’s second-highest peak and is widely regarded as the most difficult of all mountains. Before it was first summitted, a valiant American expedition led by Charles Houston in 1938 got tantalisingly close, reaching 8km – that’s 93% of the way to the top – before stalling because the food supply lines weren’t sufficient. The peak wasn’t climbed until 16 years later.

If your expedition team has stalled high up on a treacherous peak, chances are good that the supply of link equity is insufficient to keep the expedition going.

B. Missing equipment – a technical problem.

The approach to camp 2 of K2’s Abruzzi route requires successful traversing of the House Chimney, a 100’ shoulder-width icy crack in a vertical rock wall. Moving higher isn’t possible without specialist equipment.

If the way your page is set up means that Google can’t access some of the key content on your page properly, it can’t effectively promote your content in its results, and your page hits an impassable barrier despite all the other good things it has going for it.

C (i). The expedition is lost – a relevance problem.

There’s a limited number of precisely defined ways the cluster summit can be approached because Google’s interpretation of the intent behind the multiple search terms for that cluster includes only a few content types which it deems to properly answer that intent.

One cluster might reward commercial product pages as the primary content form and short, snappy how-to guides as secondary form. Another might reward long form thought leadership pieces and detailed B2B commercial explainers. One of these routes is generally most cost-effective for reaching the summit of each cluster.

If your expedition team don’t know what the most cost-effective route is, and they don’t have a precisely defined map for it, they will get lost on the mountain and not approach the summit. And the more precisely they know the route, the faster they’ll approach the summit.

C (ii). They’re arguing – another relevance problem.

The first serious attempt on K2 was made by Oscar Eckenstein and Aleister Crowley in 1902. Eckenstein was a famous climber who invented the modern crampon, and Crowley was later to become famed as an occultist with a dark reputation. The expedition was well supplied, with over 200 porters being drafted in to carry, among other things, Crowley’s vast collection of poetry books.

The expedition made 5 attempts and the best of them reached 6.5km, 76% of the way to the top. There was disagreement within the expedition team over which route to take. Crowley favoured what would later be known as the Abruzzi route along the south-east ridge, widely regarded as the safest bet today. But the Austrian contingent of the expedition favoured the North-East ridge, and this difference of opinion developed into an internal fight to which the ultimate failure of the expedition has been credited.

When the motive force behind an expedition to the top of a cluster is divided between 2 or more pages without a clear dominant page to end the conflict, neither page has the expedition’s full force behind its ascent. And even if there is a dominant page, weaker dissenting pages still impede its progress to the top.

Which of these problems does your expedition have?

Uncovering the specific combination of the above 4 problems which is impeding progression within a cluster has a not inconsiderable cost. That means it can’t be done for all clusters. The brave expedition teams on the heights are far from base camp, and while their dots can just about be made out with binoculars, a powerful telescope needs to be used if an accurate diagnosis of why they’ve stopped is desired. To look in detail and find out whether it really is a lack of links vs the competition, or whether key relevance indicators are absent from an otherwise serviceable page, or a bit of both, is an intensive act of further seeing, analysis & insight generation.

This is because, for many valuable keyword clusters, uncovering the specific actions that will be required to improve performance is complex. There are many variables and the role of natural language increases as the particulars of page content come under scrutiny, something which AI currently can’t handle well enough to be relied upon alone. An expert is needed to manage the use of powerful SEO tools, unpack the approaches of successful competitors & make the right judgement calls.

That’s expensive because the good tools aren’t free and few know how to use them properly. So it’s doubly important that this high-resolution analysis for insight into the best value actions for an individual cluster is itself prioritised effectively among all the clusters based on net gain, well before any activation of tactics to actually improve performance takes place. The alternative is a squandering of campaign resource.

Making The Best Use Of Resource: SEO Campaign Targeting With Spreadsheet-Based Narrow AI

The key elements of a keyword cluster and its relationship with a domain are numerically expressible. They manifest as a set of 3 consistently recognisable characteristics and thus lend themselves well to computational processing, and this can all be done in a spreadsheet.

The following narrow AI approach leverages this amenability in order to instantly rank keyword clusters for SEO campaigns by net gain along 4 strategic dimensions:

- Gap – The new pages you should make, in the order you should make them.

- Fix – The cannibalisation you should fix, in the order you should fix it.

- Defend – The top-ranking clusters you should defend, in the order you should defend them.

- Boost – The clusters you should boost, in the order you should boost them.

The 3 Cluster characteristics:

1. Value

What’s the price of a Google helicopter ticket to the cluster summit? The more frequently the keywords in a cluster are searched, and the more advertisers are willing to spend to capture those searches, the greater the monetary value of standing atop the cluster.

How it’s calculated:

- Search volume – More searches = more potential customers and brand awareness. We calculate how many organic clicks are up for grabs based on SERP click-through-rate studies. This can be refined with Google Search Console CTR data if you have the time.

- Click value – Ever since ‘not provided’, suggested CPC data has been commonly used to estimate conversion value for a click because the more advertisers tend to be willing to pay over a long time period, the higher the likelihood that they’re doing so because of success they experienced in driving conversions from the search term that drove the click. If you already have true average CPC data from a PPC campaign, that’s an even better measure to use.

- Combining 1 & 2 into a single metric – What would we need to pay Google to capture those clicks? Roughly speaking, this is calculated by multiplying opportunity traffic and CPC to give us Media Value. The final step is to subtract the captured media value (the value of the clicks the page currently gets) from the total media value to give us Uncaptured Media Value – the final value metric that shows us what’s up for grabs.

In cases where eCommerce revenue data by page is available and the site is established, it would be better to determine value using that data. Any relevant information you have access to can be used to calculate the monetary value to the best of your knowledge.

Client involvement is critical

Any list of clusters based on a survey of the search landscape should be collaborated upon at some level by the client because there are usually variations in the profitability of clusters which aren’t obvious from the search investigation.

A handy client scoresheet is all that’s needed to completely align the calculation of the priorities with the nuances of the client’s evolving business priorities.

Each cluster is marked with a number, 1 by default. It’s a simple multiplier. Clusters which have become irrelevant due to recent changes within the business can be marked with zero, which multiplies the value score by zero, thereby removing it from the eventual priority list. Concurrently, clusters which are particular business priorities for reasons which couldn’t be picked up by the search investigation can be marked with any number greater than 1 indicating their increased relative importance.

2. Advantage

How far up the mountain is your expedition team, and what does this say about their prospects for added success?

If the expedition is already doing great, helping it do even greater is a cost effective proposition. Google already deems it relevant, and the traffic rewards are richer for every position gained as you approach position 1.

It’s a better bet to look into developing existing success despite the added difficulty of upward movement in the higher positions because the potential for a high-payout easy fix exists, and effort can be unified on few stronger clusters rather than focusing on a set of easier-looking clusters for which current position strength is poorer.

How advantage is calculated:

- SERP position – For each keyword in the cluster, take a snapshot of your website’s position.

- CTR – Determine the click-through rate for each position. This study gives a rough guideline to the click-through-rates seen by industry and by device. These are of course generalisations, but they are accurate enough at large sample sizes. You can use GSC CTR data to refine if you have time.

- Combining 1 & 2 into a single metric – Estimated traffic share is calculated by getting the position-based CTR for each keyword’s current ranking position, multiplying this by the search volume and scaling it up to cluster level – one easy way to do this is by pivot table. It’s the single percentage value that reflects how well a whole cluster is doing, reliably revealing if it’s already on to a good thing.

3. Unity

How is your expedition team getting along – is it unified upon a single goal? This measure looks at the pages ranking in a cluster and expresses the key information about them and the cluster-level relationships between them as a single score. Is there a single dominant page ranking on which you can focus your efforts? Or are the rankings cannibalised across multiple competing pages – and if so, is it bad enough to stop the expedition from succeeding right away, even if you bolster its supply lines?

How it’s calculated:

- Search volume split across ranking pages – Within a cluster, how is the available total search volume for those keywords split across each page which is ranking? This gives an indication of how much relevance the search engine is assigning to each page in relation to the cluster, even if the ranking positions in question are far below the click threshold.

- Identify the dominant page & compare – The dominant page is the page covering the greatest total search volume in the cluster. Knowing this page, we can compare vs non-dominant pages to get a reliable idea of how fragmented a cluster is, and importantly, whether this fragmentation is serious enough to matter in relation to the campaign aim. Sometimes it’s not a big deal – for example, a non-dominant page ranking for 3% of the cluster volume will have little or no detrimental impact on cluster performance. So these patterns, when identified, are not flagged as problems.

- Variation in average rank across ranking pages – Compares the distance between the average rank of the dominant page with the average rank of the cluster, which reveals major differences in relevancy assignment within the cluster – another red flag.

- These are multiplied together based on a set of criteria to give a single score which reveals how unified your expeditions are for each cluster relative to the average unification across all clusters. This allows the worst problems of this type on the site to be identified and ranked in order of severity.

One thing to note – The use of this measure as a cannibalisation detector depends on the clusters being properly constituted. This is particularly handy if you didn’t do the clustering yourself and it needs improving – it can alert you to clusters which should be split or which contain irrelevant keywords. It’s a smart measure in that it won’t trigger if there’s just a handful of irrelevant keywords left over from the keyword gathering stage – it’s only when the presence of irrelevant keywords will have a measurable impact on the SEO campaign targeting that a problem is flagged with the cluster.

From Cluster Characteristics To Campaign Priorities: 4 Strategic Shortlists

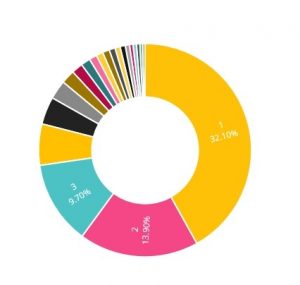

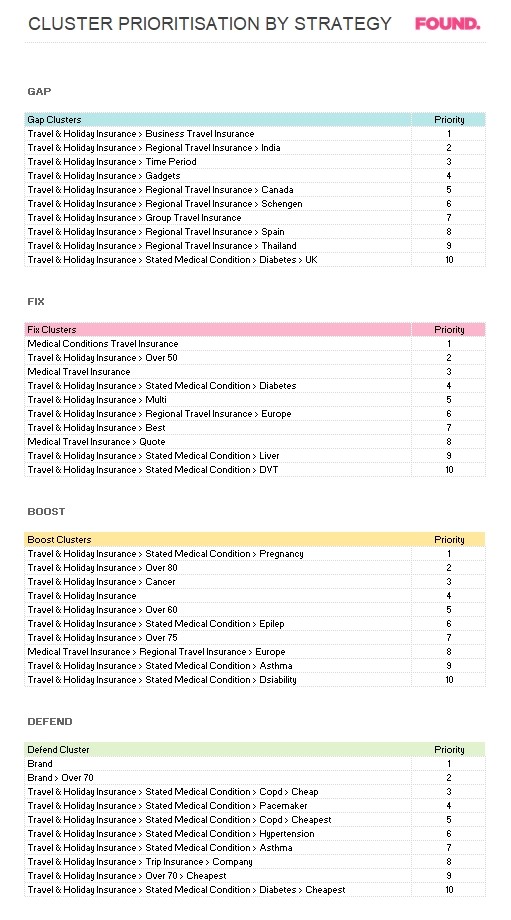

Now the vital statistics of your clusters have been nailed down, the information is processed into 4 ranked shortlists (Gap, Fix, Defend, Boost) based on a comparison of the dominant characteristics of each cluster.

The 4 shortlists are produced when weighting formulas run through a series of ordered checks:

- Detect gap clusters & rank them by priority – These are clusters for which no page is ranking, and for new sites, this is the focus. Priority is calculated by value and AdWords competition level is factored in as a guide to modify for difficulty in relation to value so the easiest new-page wins are explored first. The output – The gap shortlist.

- Check for cluster unity – For the clusters that are not total gaps, is there a solid page you can focus on to improve performance – or do you need to go in and split or consolidate the targeting to address cannibalisation before you can expect good results in response to campaign activity? Those which need looking at are identified and listed in order of severity. The output – The fix shortlist.

- Check if the cluster summit has already been reached – If this is the case, you need to know because the strategy will become one of defense. The output – The defend shortlist.

- For what’s left, which will be the majority of the clusters if the site is established, a simple equation is applied to determine which of them will yield the best net gain from being further examined & boosted by campaign activity, the output of which is the boost shortlist:

Value score x advantage score = boost priority score.

The final output:

Results Deep dive

The Boost priorities – A closer look

While the clusters with the greatest uncaptured media value tend to congregate at the top, their prioritisation for the campaign is tempered by consideration of the traffic share as an indicator of the likelihood of future success in response to the application of campaign budget.

Example 1 – The giants are humbled

Travel & Holiday Insurance > Regional Travel Insurance > Europe, the cluster with the highest uncaptured media value, is only the 8th priority because the current traffic share is tiny at 1%. However, it’s so valuable that even moving from, say, #16 to #12 is still something worth pursuing as a lower priority.

In a similar vein, Travel & Holiday Insurance > Regional Travel Insurance > USA, the cluster with the 6th highest uncaptured media value, is relegated to slot 22.

Example 2 – David defeats Goliath

Travel & Holiday Insurance > Cancer, with the 25th highest uncaptured media value, is ranked 3rd priority because it’s doing very nicely at 17% traffic share. The keywords are in positions 2-5, which means an upward move will radically increase clicks, providing the best net gains provided the page is set up to convert.

But the real gem, found at the top of the list, is the automated identification of Travel & Holiday Insurance > Stated Medical Condition > Pregnancy as the Kilimanjaro of our search landscape.

Summit Kilimanjaro, not K2.

Mount Kilimanjaro is 5.9km high. Just 68% of K2’s 8.6km majesty. But it’s also 68 times easier to climb (that’s a fact). And 300 times less dangerous to climb (that actually is a fact). Kilimanjaro is the best bet for climbing up as high as possible for the least effort possible.

Travel & Holiday Insurance > Stated Medical Condition > Pregnancy’s uncaptured media value is £38,360 per month. It’s quite a bit less than Travel & Holiday Insurance > Regional Travel Insurance > Europe’s £61,511. Yet, it’s the Kilimanjaro of this campaign. It may have only 62% of the uncaptured media value of its bigger brother, but the expedition to climb it is already in such a good position for further success, with existing top-5 ranking for major keywords, that this is easily outweighed.

Focusing instead on the Europe cluster as the priority, which is what we’d do if we were looking only at cluster value, would be more akin to attempting K2. It’s not that K2 should never be attempted. On the contrary, there’s great value in reaching even camp 1 (say, position 18) for the highest volume relevant search terms, and this is built into the prioritisation system. But unless you have a crack expedition team that’s already near the top, attempting to summit K2 is unlikely to be the best use of your money. Plus, think of your pages. They don’t want to go up there. What sane page would?

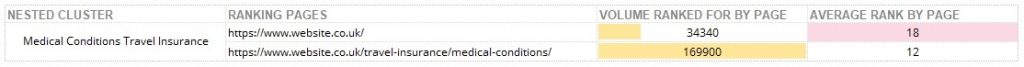

The Fix priorities – A closer look

Example 1 – Clash of the titans

Topping off the list, we have ‘Medical Conditions Travel Insurance’. A common issue has been revealed – the homepage and a strong inner page are competing for dominance within this major cluster. This is the top priority to go in and fix because the volumes involved are huge, and the weaker page for the cluster (homepage) is ranking considerably worse – you could rank better for those keywords if you had a stronger single page. There are huge search volumes ranked for across the lower half of page 1 and across page 2, and the amount of this which is cannibalised is considerable. As this is the core topic for the client, its place at the top of the fix list is well deserved.

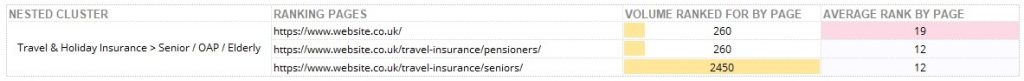

Example 2 – Textbook cannibalisation to sort out later on if there’s time

Travel & Holiday Insurance > Senior / OAP / Elderly

Ranked as the 24th fix priority. It’s a clear example of cannibalisation, with 2 content pages approaching the same meaning with different phrasing – but the volume at stake isn’t high enough and the pages don’t rank all that well for any keywords with appreciable volume. So it’s not a high priority to sort out.

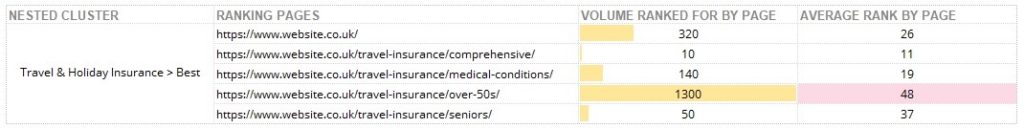

Example 3 – Opportunity out of chaos

Travel & Holiday Insurance > Best

This one’s got a decent volume with lots of pages ranking. It’s very fragmented and the differences in page relevance for the keywords in the cluster are high, which has earned this cluster a fairly high fix priority score. A brief look reveals that it’s a cluster in chaos. Although the site is being considered for ‘best’ terms, there is no existing page which focuses on it. A single page needs to be defined or created to target these valuable terms.

An Instant Map To Guide Your SEO Campaign

Knowing what can be ignored when striving toward an aim is essential to acting effectively in pursuit of that aim. Otherwise, there’s too much information to be considered, much of it irrelevant. Considering irrelevant information is costly.

SEO practitioners have long been able to collect information and derive great campaign prioritisation insights from it – it’s industry standard. Yet this is all too often an ill-defined, time-consuming and manual affair, relying on the individual flair of the expert.

The instantaneous cost-efficient transformation of the information into a usable map specifying what can be ignored and what can’t be ignored is where this approach delivers its added value.

Every SEO campaign has its Kilimanjaros. Let the AI find them. So you can concentrate on climbing them.